Risk is part of the day to day running of any business. Some risks are relatively minor and others can put you out of business pretty quickly. All business should evaluate their risks and formulate sound and robust risk management practices and protocols to minimise, manage and if possible avoid them. Transferring risk to insurance is an effective risk management tool to protect against many of the risks your business faces.

You can insure against most business risks. You need to decide which risks you want to transfer to insurance and which risks you are prepared to bear yourself or manage in some other way. For some professions certain types of insurance is compulsory either by law or by a requirement of the registration process.

Your clients can impose insurance obligations on you via the contract that governs your relationship. Other contracts such as lease agreements for property, office equipment or motor vehicles can also impose insurance obligations on your business. Make sure you read these contracts carefully and comply with the insurance requirements.

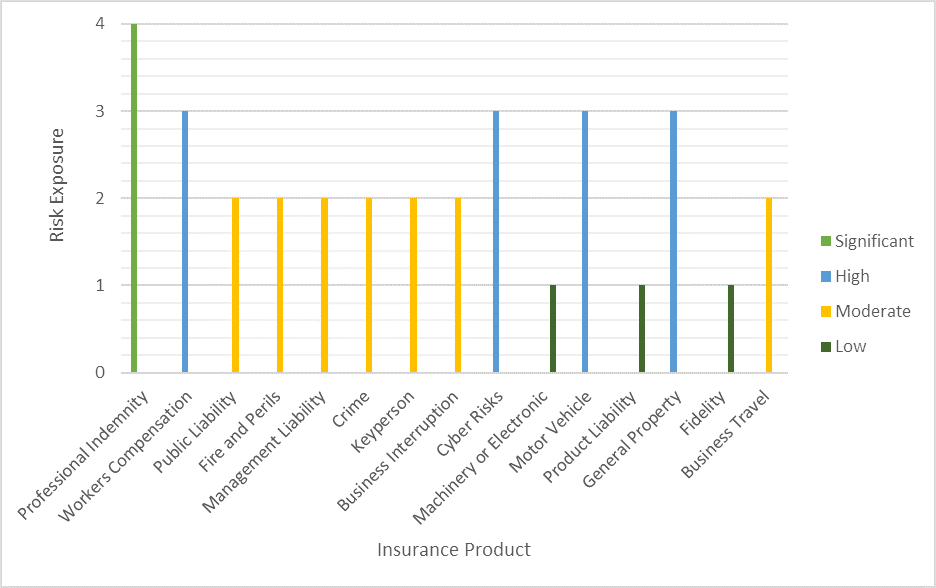

The graph below shows the potential exposure levels faced by various design professionals to common risks that can be covered by insurance. The table provides a brief explanation of what the insurance policy covers and which of those policies are recommended for design professional practices given the exposure level and potential claim costs.

It is also important to understand that all insurance policies have exclusions. This means that even though you have transferred a risk to an insurance policy there may be some areas of that risk that are excluded from the policy and therefore not insured. For example risks associated with asbestos are generally excluded from most insurance policies. As are risks associated with general maintenance, or lack thereof, wear and tear or deliberate acts by insured persons.

Most insurance policies have excesses or deductibles meaning that if you make a claim you are required to contribute to the costs of the claim by paying the excess or deductible. The excess or deductible can be a dollar amount or a time period or both depending on the type of insurance.

The information contained in this article is general in nature, you should always get specific advice from a general insurance broker regarding the risks associated with your business and the insurance policies that can protect those risks. Contact your local Planned Cover branch for specific advice regarding your business.

Vanessa Collins

Projects/Compliance Manager

| Type of insurance | Should you buy it | Description |

| Professional Indemnity | Compulsory | Covers the liability associated with the design professionals services. Architects in particular are required to hold PI insurance by law in most states and territories. Registration boards also require proof of current PI insurance when registering each year. |

| Workers Compensation | Compulsory | Covers injury sustained by your employees whilst they are at work. Each state/territory has varying requirements. In an office environment stress is the largest risk. |

| Public Liability | Highly recommended | Covers the general liability associated with running a business. PL insurance is often contractually imposed by a landlord when you lease office space. Whilst the risk exposure is moderate the potential cost of a claim is high. |

| Fire and Perils | Recommended | Covers the assets of your business against loss or damage caused by fire, storm, water damage and many other events. Is usually packaged up in a business insurance policy with other general business risks. |

| Management Liability including Employment Practices, Statutory, and Directors and Officers liability | Recommended | Covers the personal liability of the Directors and Officers of the business for their responsibilities relating to company management, corporate governance and statutory compliance. It covers the business for employment related actions such as wrongful dismissal or workplace harassment. It covers (most) statutory fines and penalties the business may incur as a result of breaching legislation or regulation. |

| Crime | Recommended | Covers the business assets against theft. Is usually packaged up in a business insurance policy with other general business risks. |

| Keyperson | Consider | Covers the business against the loss of a key person from illness or injury. It can cover both the loss of potential earnings the key person would have otherwise made or in the event of total disablement or death pays a lump sum to the business to buy out the shareholding of the key person. |

| Business Interruption | Recommended | Covers the loss of earnings of the business following a fire and perils loss. Also covers the additional costs associated with getting the business back up and running after a loss. Is usually packaged up in a business insurance policy with other general business risks. |

| Cyber Risks | Highly Recommended | This is a rapidly increasing area of risk. Covers the costs associated with various types of cyber crimes including hacking, cyber theft, denial of service, ransom attacks, data breach etc. It covers the costs to the business as well as the liability to third parties and potentially any fines associated with the release of data. |

| Machinery or Electronic | Consider | Covers machinery or electronic equipment for breakdown. Loss of data as a result of the breakdown is also covered. Is usually packaged up in a business insurance policy with other general business risks. |

| Motor Vehicle | Recommended | Covers the damaged caused to the business vehicles and the damage those vehicles cause to other vehicles or property. |

| Product Liability | Consider | Is often automatically covered by public liability policies. It is highly recommended for business that manufacture, sell, store or distribute products. |

| General Property | Consider | Covers portable equipment such as phones, computers etc whilst they are outside the office. Whilst the exposure is high the potential claim costs are usually low. Is usually packaged up in a business insurance policy with other general business risks. |

| Fidelity | Consider | Covers the business against misappropriation of funds by employees. Is usually packaged up in a business insurance policy with other general business risks. |

| Business Travel | Consider | Covers the business for costs associated with travel risks such as medical/evacuation costs of the employee whilst overseas, loss of luggage, cancellation expenses, kidnap and ransom, personal liability etc. Whilst the exposure is moderate potential claim costs can be high. |